Blog

The Journey to Tesla 4680 Battery Breakthrough: Five Years of Ambition and Risk

Tesla will not be launching any new models for sale this year, but there may be a new battery. We have exclusively learned that Tesla plans to mass-produce a fully dry electrode version of the 4680 battery by the end of the year, which will be the "complete version" of the 4680 battery. In 2023, Tesla has already used 4680 batteries in the Cybertruck, but it was a compromised version that failed to achieve the goal—to reinvent the battery manufacturing process by replacing traditional wet electrodes with dry electrodes, thereby eliminating the process of wetting and then drying the electrode, speeding up production, and reducing costs. Currently, Tesla's 4680 batteries only use dry electrodes for the less expensive negative electrode, while the more expensive positive electrodes are still sourced from LG Energy Solution and two Chinese battery companies using the traditional wet electrode process.

Tesla is now just one step away from achieving the "complete version" of the 4680 battery. We have learned that the design for the dry positive electrode 4680 battery was recently finalized, which is a crucial step before large-scale mass production. The next focus for Tesla's battery department will be on improving production yield and efficiency, as well as expanding production capacity.

It is understood that Tesla had already produced dry positive electrode rolls in the laboratory by the end of 2022, but due to a technical misjudgment, mass production was delayed. After the project leader, Drew Baglino, left in April this year, Tesla adjusted its technical direction, and breakthroughs were made in the mass production of the dry positive electrode. "Making the dry electrode will change Tesla," said a Tesla insider.

The 4680 battery was introduced by Tesla in 2020 as a self-developed battery. Tesla claimed at that time that the new technology could reduce battery costs by 50%, leading to cheaper new cars. The key to significant cost reduction lies in the dry electrode process. Currently, the positive and negative electrode materials in electric vehicle batteries are slurries, known as "wet electrodes," which require drying, solvent recovery, and other processes, resulting in long production times and large factory footprints. The dry electrode eliminates these processes, significantly reducing the capital investment required for factory space and unit battery production capacity, while also improving battery performance and production efficiency.

The dry positive electrode is the most crucial and difficult part of the entire 4680 battery process, and positive electrode material is the most expensive component of the battery, accounting for more than 35% of the cost. We have also learned that, alongside tackling the dry electrode challenge, Tesla is continuing to improve the packaging process and material composition of the current compromised version of the 4680 battery, which will be prioritized for the Cybertruck. Currently, Tesla's in-house production of the 4680 battery is sufficient for about 1,000 Cybertrucks per week.

According to insiders, the suppliers of materials for these 4680 batteries produced in the United States by Tesla now include almost no Chinese companies, and some of the production equipment has been switched to suppliers from Japan, Europe, or the United States. Tesla is also seeking alternatives for those processes that still use Chinese equipment. On the other hand, Tesla also plans to have LG Energy Solution directly supply complete wet positive electrode 4680 batteries in the second half of this year, which will be installed in Model Y vehicles produced in the U.S.

The 4680 battery is central to enhancing the competitiveness of Tesla's next-generation products, and the dry positive electrode is at the core of the 4680. Since the project's inception, Tesla has spent five years on this endeavor.

After overcoming the research and development hurdles, the next step is engineering optimization.

A simple rule for success in manufacturing is to make better products than competitors at a lower cost. Over the past five years, Tesla has followed a clear path to reduce costs and improve efficiency—using larger integrated die-casting machines to shorten vehicle body manufacturing times, designing the next generation of cars with fewer parts that are easier to manufacture, using dry electrode technology to reduce battery manufacturing costs, using "unboxed" technology to shorten vehicle assembly time and costs, and building more efficient gigafactories. Tesla has invested billions of dollars and significant engineering resources into these hardware and manufacturing innovations. If the plan succeeds, Tesla will be able to maintain the industry's leading profit margins and operational efficiency as it did three years ago.

However, since April of this year, Tesla has gradually suspended these efforts: pausing the production of a $25,000 affordable model, halting research and development of larger integrated die-cast vehicle bodies, and delaying construction of the next-generation gigafactory in Mexico, which was originally scheduled to start production this year. The 4680 battery also seemed to be in jeopardy. In April this year, Drew Baglino, who worked at Tesla for 17 years and was the senior vice president of powertrain and energy engineering, left the company, and about 25% of the battery team was laid off that month, leaving fewer than 800 people.

In a previous follow-up on the layoffs, we mentioned that Tesla's management had set a clear goal for the battery department at the beginning of this year: If, by the end of this year, the production cost of Tesla's own 4680 battery could not be lower than that of suppliers like LG Energy Solution and Panasonic, Tesla would consider abandoning in-house production of the 4680 battery. This is not a low standard; if Tesla truly achieves lower production costs than LG, it will be the cheapest domestically produced battery in the U.S.

Recent progress in the dry positive electrode provides the battery department with the possibility of meeting this year-end goal. After Baglino's departure, Tesla's battery team decided to take a slightly higher-cost but faster-to-market approach. Earlier, Tesla's engineering team had already made dry positive electrode rolls in the laboratory by the end of 2022, and the next step is to replicate this in mass production.

Currently, the general process for producing power batteries is to coat the positive and negative electrode materials onto foil sheets to make electrodes, roll them into electrode rolls, place them into battery cases, inject electrolyte, and complete the process with welding. However, during mass production of electrode rolls, Tesla faced difficulties with the rolling process. "The dry positive electrode process faced significant challenges. The positive electrode powder is extremely hard, and sometimes it damages the electrode equipment, which we did not anticipate," Elon Musk said during Tesla's 2022 earnings call.

An engineer who used to work in Tesla's battery department said that Tesla only has a few customized and tuned pieces of dry positive electrode rolling equipment. When this equipment breaks, it takes at least 45 days to repair, causing the battery team to waste a lot of time. He recalled that when Baglino was still in the position, he had to face weekly questioning from Tesla's former CFO, Zach Kirkhorn. "In the cost histogram, the battery cell department is off the charts, while other departments are at the bottom."

There were internal discussions within the battery department about addressing some of the engineering challenges encountered with the dry electrode after the rolling and winding stages, as there was limited room for modifying and optimizing the rolling equipment. According to the source, doing so would make things much simpler, as Japanese equipment companies have mature solutions, but Tesla would need to replace some production equipment, which would involve additional equipment expenditures and other R&D uncertainties. This plan had not received approval from Tesla's top management before. Recently, Tesla's battery department started to attempt this previously rejected approach, switching to another set of equipment and addressing the yield issues of the electrode rolls after the rolling and winding stages, making some progress.

According to someone close to Tesla, the reason for the recent increase in confidence within the battery department is that they believe they have now passed the most difficult stage of R&D, and the next steps are mainly engineering optimization issues. Tesla can improve efficiency with some detailed improvements. For example, a Tesla employee mentioned that when there were defective electrodes on the production line, an ordinary battery company would cut off a few dozen centimeters of defective film, but Tesla would cut off several meters of electrode film. This resulted in Tesla bearing higher defect loss in battery production, and it was also more difficult to pinpoint the problem. "This is mainly because we don't have enough engineers to conduct the tests," he said, but fortunately, in the coming steps, more tests could be conducted by basic technical personnel, "the route is now clearer, and it just takes time to solve it."

Tesla hopes to produce some batteries in-house and reduce dependence on external battery suppliers.

Prior to the 4680 battery, Tesla had never fully produced batteries in-house. The first batch of Tesla’s mass-produced cylindrical batteries was co-produced with Panasonic. By 2020, when Tesla was already selling 500,000 cars annually, a relatively stable battery supply structure had been formed: prismatic batteries were supplied entirely by CATL, mainly used for standard-range Model 3 and Model Y models, and CATL supplied not only the Shanghai factory but also exported to Tesla's U.S. factory; cylindrical batteries came from Panasonic and LG, used for long-range and premium models.

Since Tesla started in-house production of the 4680 battery in 2023, it has changed its battery supply chain, reducing its reliance on external suppliers, including Chinese suppliers. Currently, the "compromised version" of the 4680 battery produced at Tesla’s Texas factory uses wet positive electrodes from LG and two Chinese companies, combined with Tesla's own dry negative electrodes. If the mass production of the dry electrode 4680 battery is successful and yields reach a high level, Tesla will be able to fully produce 4680 batteries in-house, without relying on suppliers to produce core components. External suppliers would lose some incremental orders from Tesla.

In Musk's optimistic vision in 2021, Tesla aims to produce at least 30% of its automotive batteries in-house in the future. As Tesla starts to produce more batteries itself, there is another opportunity for Chinese supply chain companies—to provide Tesla with equipment. However, as we understand, Tesla has not yet approached Chinese equipment manufacturers for key processes like coating, rolling, and winding of the dry positive electrode. The core suppliers are from Japan and Germany.

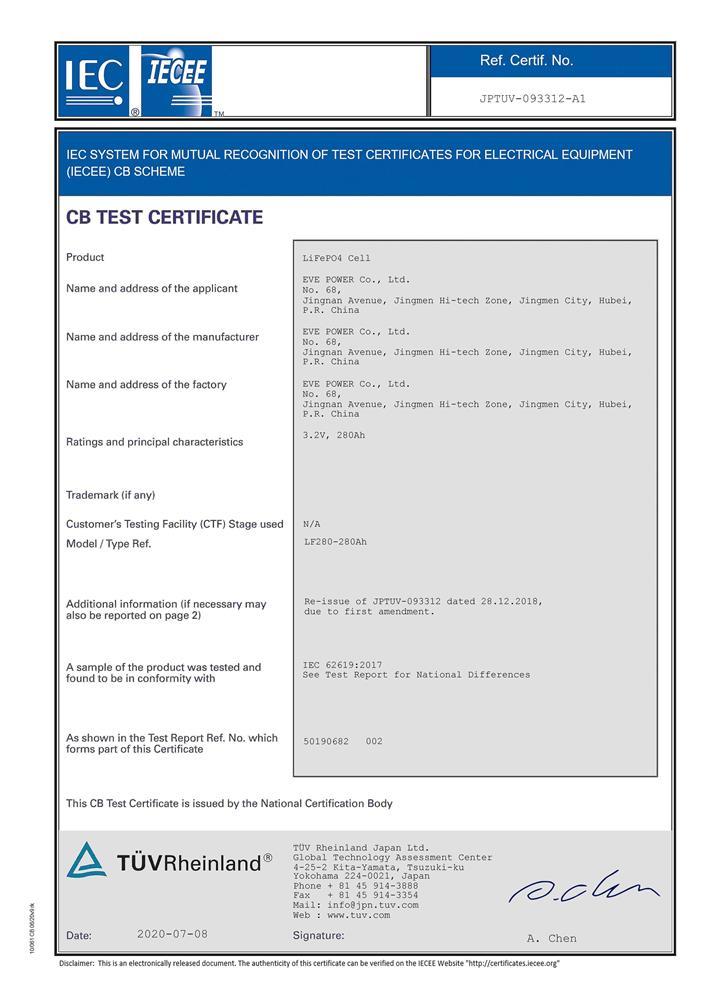

However, whether Tesla’s dry positive electrode 4680 can maintain a cost advantage still has variables. It depends on how quickly the yield and production scale can be increased for the dry positive electrode 4680. If the yield is too low, it will negate the benefits brought by eliminating drying and other production steps. Since Tesla proposed the 4680 solution in 2020, other companies in the industry have followed suit, such as LG Energy Solution, EVE Energy, and Panasonic. Although CATL does not favor the 4680 route, they also have technological reserves and are researching dry electrode technology. Even if it takes some time, once other companies can also mass-produce dry electrode 4680 batteries, Tesla will face a new round of manufacturing efficiency competition, and when companies are using the same generation of technology, Tesla's strength may not lie in extreme cost reduction.

Companies like CATL and others are also exploring the next generation of batteries—solid-state batteries, which also require dry electrode technology. It is a consensus in the industry that solid-state batteries are the ultimate form of automotive batteries. While tackling the dry positive electrode for the 4680, Tesla is also deepening cooperation with Chinese companies like CATL. Earlier this year, CATL started a joint venture with Tesla in Nevada to build a lithium iron phosphate battery plant for energy storage. Tesla is purchasing production lines directly from CATL, and CATL is providing some technical and procurement support, earning technology licensing fees. Currently, the battery cost for CATL and BYD is around 0.33 RMB/Wh, still the most affordable and cost-effective battery globally.

- Next:Do LiFePO4 Batteries Need to Be Vented?

- Previous:OTS LiFePO4 Batteries vs DIY LiFePO4 Batteries: Key Differences You Need to Know

Contact Details

Lithium LiFePO4 Batteries and Lithium LiFePO4 Cells Supplier - LiFePO4 Battery Shop

Contact Person: Miss. Elena Wang

WhatsApp : +8615263269227

Skype : +8615263269227

WeChat : 15263269227

Email : info@lifepo4batteryshop.com

All Products

Certification

Customer Reviews

- I have fond memories of our meeting in Shanghai with LiFePO4 Battery Shop Elena. Your company left a strong impression on me with its impressive growth and professionalism. We both value straightforwardness and honesty, which I believe are the most important qualities in any partnership. I am confident that we can build a successful collaboration based on these shared values. —— Robert from USA

- I've been working with LiFePO4 Battery Shop for years, and their reliability is unmatched. While other suppliers frequently change sales teams, LiFePO4 Battery Shop has consistently provided exceptional service with a stable team. Their commitment to quality and customer support truly sets them apart. —— Henry from Australia